There are several taxes in Portugal and, if you want to retire in Portugal or work here, then you should know more about them: there is IRS (which is the personal income tax), IRC (which is the corporation tax), IVA (which is the value added tax or VAT), IMI and IMT (which are property taxes), ISV (which is the vehicle property tax) and IUC (which is the vehicle circulation tax).

In this article I’m going to talk about taxes in Portugal, more specifically about the personal income tax (IRS) and how much Portuguese employees and retirees deduct in comparison to British and American realities.

Personal Income Tax (IRS) for employees

Sommaire

Disclosure: This post may contain affiliate links, meaning i get a commission if you decide to make a purchase through my links, at no cost to you. Please read my disclosure for more info.

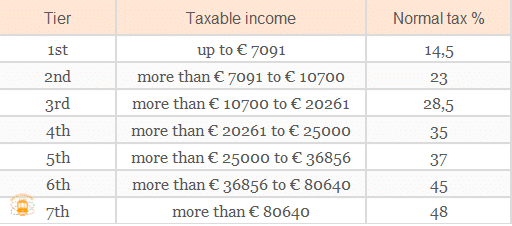

The tax rate over personal income in 2015 (tax return 2016) was the following:

To explain how to calculate the Portuguese personal income tax, I’m going to give you the example of a single person, without children, that earns 1500 € monthly of gross salary as an employee.

In Portugal, salary is multiplied by 14 months (the 12 months in the year, the holiday pay and the Christmas bonus, each equivalent to another salary). So, whoever earns 1500 € of gross salary every month, at the end of the year will have earned 21 000 €.

Of the 21 000 €, there is a deduction of 4104 € for taxes, leaving 16 896 € that are subject to the personal income tax.

The 16 896 € are part of the third tier of the tax rate (28.5 %) but only 6197 € are taxed at a 28.5 % rate; the first 7091 € are taxed at a 14.5 % rate and the remaining 3608 € are taxed at a 23 % rate.

In total, in Portugal, the personal income tax of an employee, single and without children, that earns 1500 € gross is:

7091*14,5 %= 1028 €

3608*23 %= 830 €

6197*28,5 %= 1766 €

TOTAL: 3624 €, equivalent to a tax rate of 17,26 %

Source: http://www.ricardomcarvalho.pt/blog/como-funciona-o-irs/

In comparison to the United Kingdom, an employee, single and without children, that earns 21 000 £ will pay 3182.36 £, equivalent to an income tax of 15.2 % (in 2019).

Source: https://listentotaxman.com

In comparison to the United States, an employee, single and without any children, that earns 21 000 $ will pay 2486 $, equivalent to an income tax of 11,84 % (in 2019).

Source: http://goodcalculators.com/us-salary-tax-calculator/

In Portugal, the personal income tax is deducted at source, which means that of the 1500 € gross the employee earns every month, 267 € are deducted for IRS (tax withholding of 17,8 %) apart from the 165 € (11 %) deducted for Social Security. In total, the net wage for this employee is 1068 €.

Personal Income Tax (IRS) for retirees

Presently, the Portuguese state offers to all the foreign retirees who have worked for the private sector and live in the country, personal income tax exemption for the first ten years.

To benefit from this tax exemption and apply for the non-regular resident status, you must live in Portugal at least 183 days per year and not having lived in the country in the previous five years.

To avoid problems with your home country’s tax office, you should not have any tax residence, preferably you should sell your house or vacate the place you were living in if it was a rental.

After the ten-year exemption, you’ll have to pay personal income tax like any other Portuguese retiree except if the Portuguese state renews that exemption.

Presently, a Portuguese retiree earning a pension of 1500 € gross every month, will earn 1226 € net wage, which means a tax rate of 18.23 %.

Taxes in Portugal: should you move to this country?

As you have seen, the tax rate in Portugal is much higher than in other countries (18.23 %). A person earning 21 000 £ or 21 000 $ (in the UK and USA, respectively) will always pay less personal income tax than a Portuguese person.

Even though taxes in Portugal are higher than in countries like the United Kingdom or the United States of America, the truth is that cost of life in Portugal is much cheaper than in those countries. In other words, people earning 1500 € gross every month in Portugal will have a much higher standard of life than in their home countries.

For a retiree, non-regular resident, the standard of life will be even higher thanks to the ten-year personal income tax exemption.